Automatic banking reconciliation software

The Cegid Exabanque accounting reconciliation optional module automates the lettering of your banking entries (for SEPA payments and collections: SCT and SDD) in order to improve the reliability of your accounts.

Automatic reconciliation rules

The software is supplied with automatic reconciliation rules, which are based on:

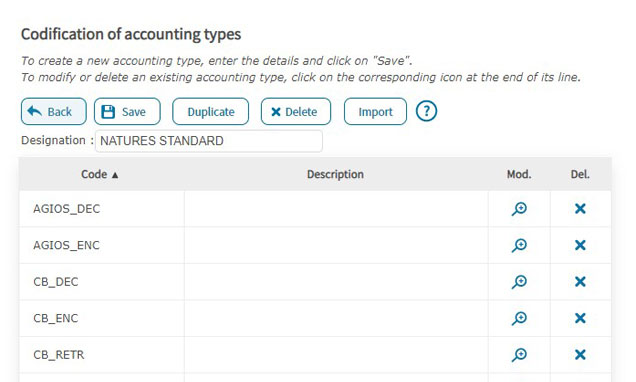

- The choice of an accounting classification system that is

- Pre-established

- Can be personalised

- Creating a correspondence table with your accounting entries

Using these reconciliation rules, Cegid Exabanque can automatically perform reconciliation (single or multiple) of the following types:

- 1 to X

- X to 1

- N to N

How does Cegid Exabanque facilitate banking reconciliation?

To perform reconciliation, the Cegid Exabanque software draws on the data from your account statements which have already been integrated into the program via the banking management module, as well as your accounting entries, which you have either imported or entered.

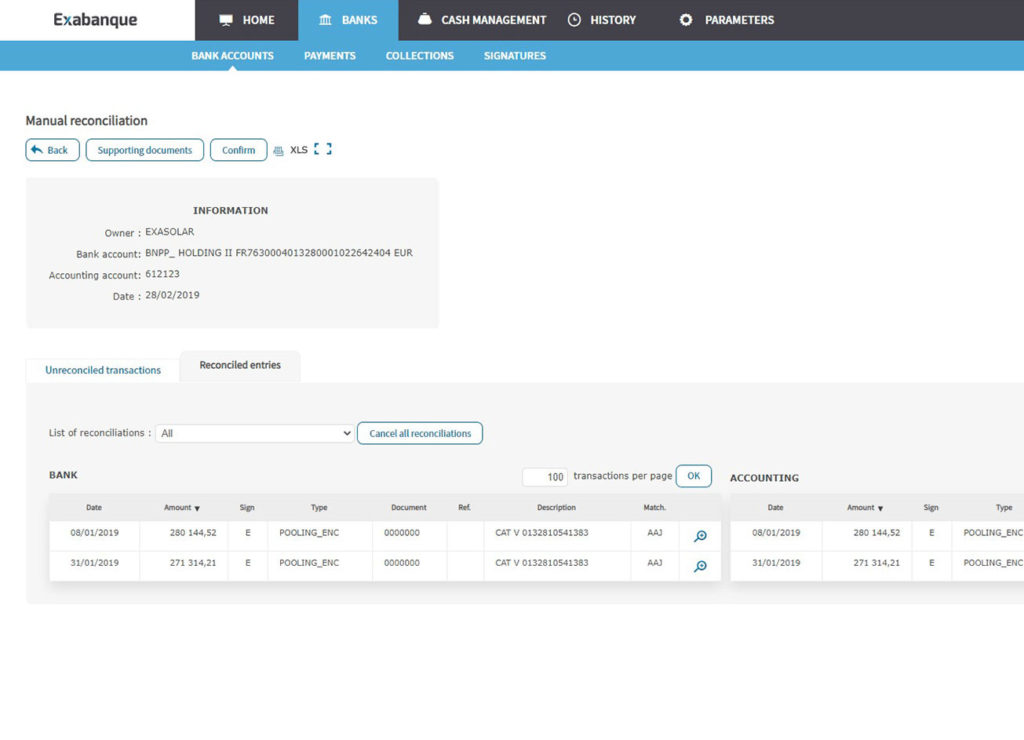

Once automatic reconciliation is complete, you can manually reconcile the remaining transaction entries. The entries are displayed in two tables side by side (Bank/Accounting) in order to facilitate manual reconciliation.

Once manual reconciliation has been carried out, the periods are closed, the accountant can begin to draw up the accounts and issue the relevant supporting documents.